In a recent report by Australia’s corporate watchdog the Australian Securities and Investments Commission, it was revealed that some Aussies are having to cut back on daily necessities, like meals, due to the amount of debt they have racked up on Buy Now, Pay Later (BNPL) arrangements. The report announced that a whopping one in five consumers fall into this category of missing their payments.

Now, if you’re unsure what the Buy Now, Pay Later model is, it’s basically an arrangement that allows consumers to buy and receive goods and services immediately but pay for that purchase over time.

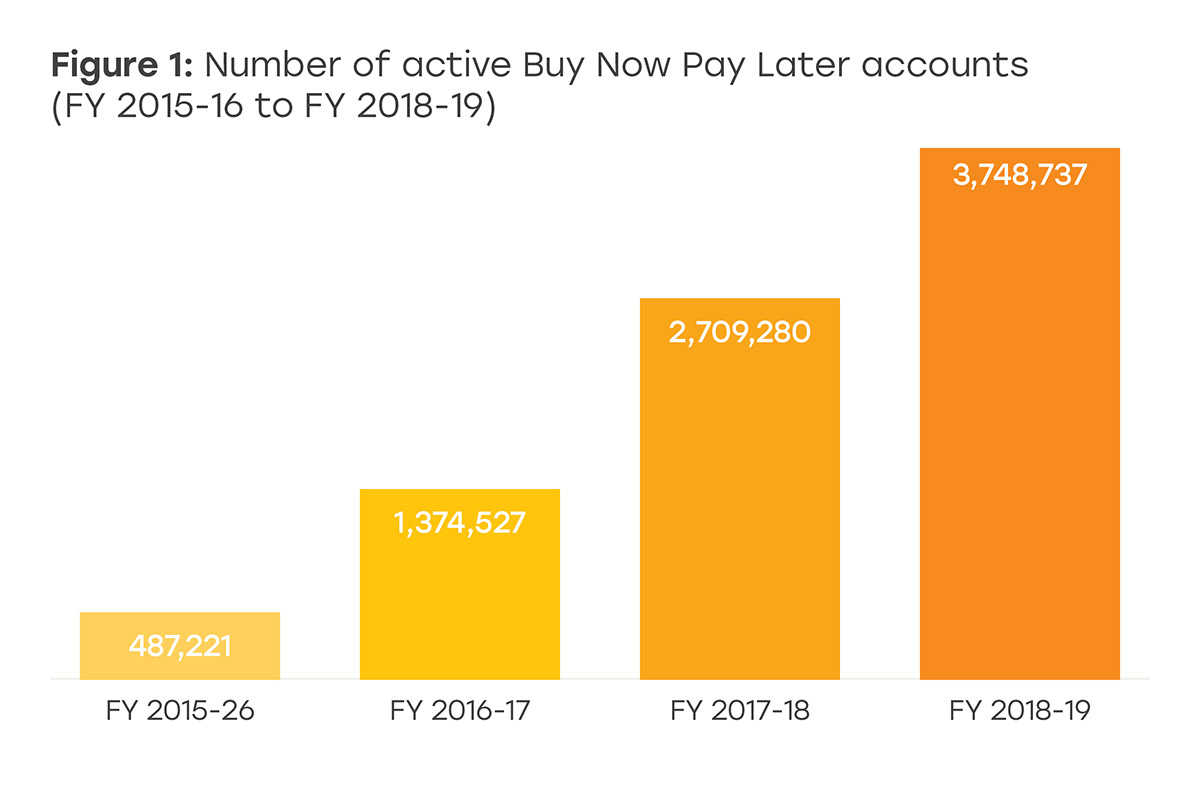

This way of spending has become increasingly popular with records showing that the BNPL industry has almost doubled in the last 12 months. More specifically BNPL transactions soared to 32 million in the financial year 2018-19, representing an increase of 90%.

Below is an image showing the number of active BNPL accounts between FY 2015-2016 and FY 2018-2019 which demonstrate the industries exponential growth.

Source: ASIC

The report also highlighted that there were more than 6.1 million open accounts as at June 2019, which represents up to 30% of the Australian adult population1.

How is the BNPL model affecting consumers?

ASIC’s review into six of the major BNPL players concluded that some were causing consumers harm. The review dug into how consumers are being burdened with additional costs due to missed payment fees, which subsequently resulted in reports of financial stress that related to consumers not being able to meet their other financial commitments.

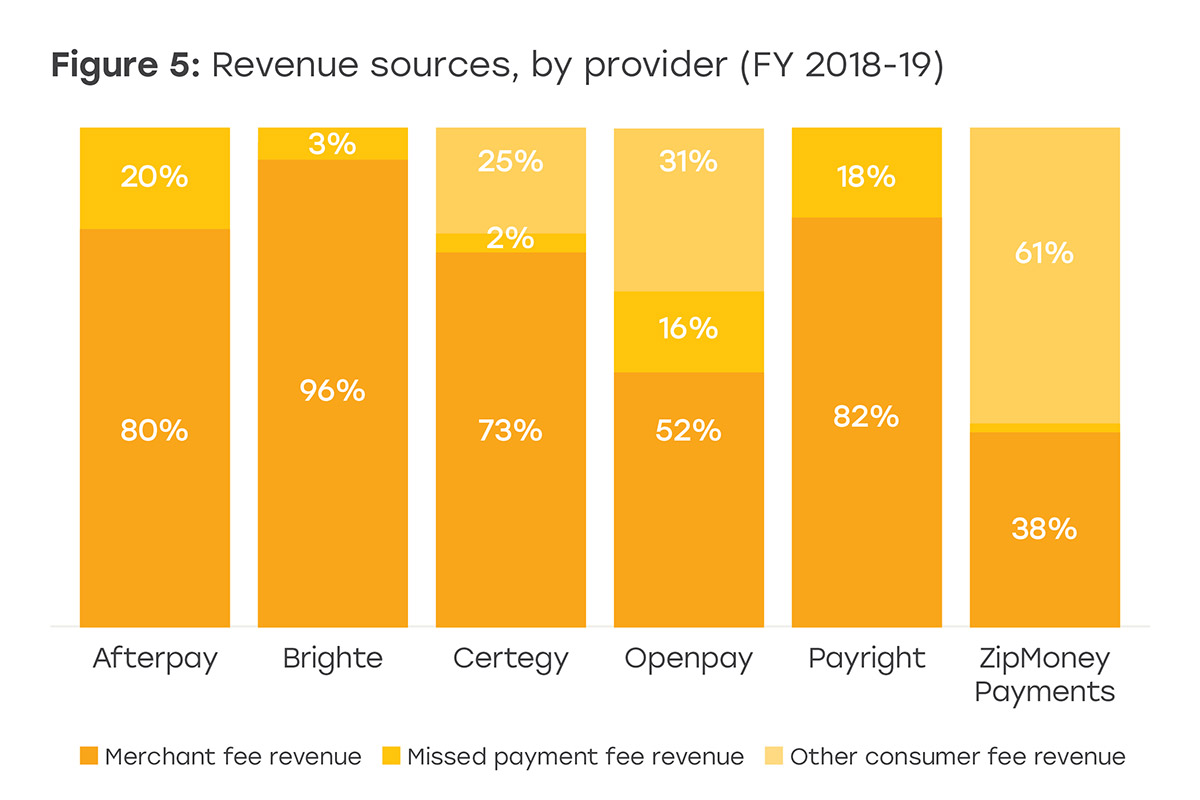

In the 2018-2019 financial year, the revenue earned from missed payment fees for all BNPL competitors in the review totalled over $43 million (what?!) – this calculated out to be a growth of 38%.

The image below shows Revenue Sources broken down by the different providers in the market. As seen below in the Afterpay example, the BNPL player reported revenue in FY18-19 of 20% in late fees alone.

Source: ASIC

So, despite the initial appeal of a Buy Now, Pay Later option, consider if it is the right choice for you and your other financial commitments and goals at the time.

If you’re a little lost on where to begin with planning out your financial goals and commitments, look at our free Money Mentoring service as a starting point. With a qualified budgeting specialist by your side, you can expect to receive genuine advice on budgeting and practical solutions, as well as an easy to follow plan that is individually tailored to you.

1. Australian Securities and Investments Commission. (November, 2020). REP 672 Buy now pay later: An Industry update report. View the report here.