July 2025

Welcome to our quarterly newsletter, which is published early January, April, July and October. Enjoy the read!

General Advice Warning: The information in this newsletter is intended to be general in nature and is not personal financial advice. It does not take into account your objectives, financial situation or needs. Before acting on any information in this article, you should consider the appropriateness of the information provided. In particular, you should seek independent financial advice.

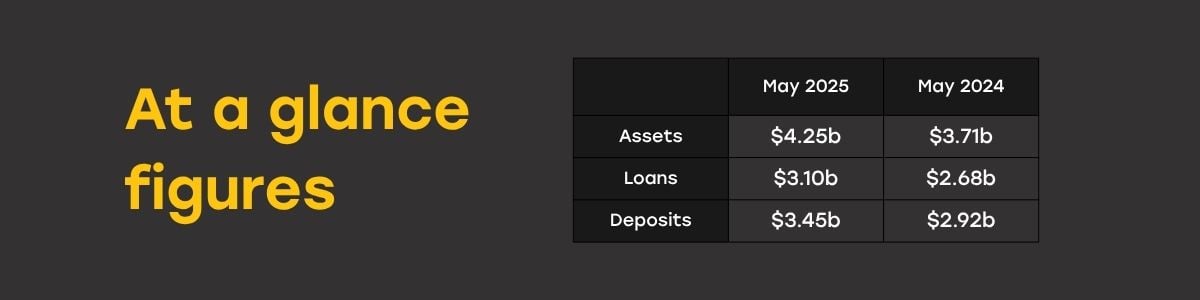

When reflecting on the 2024/25 financial year, I am pleased to report to Members that the bank has made considerable progress in a number of areas as we pursue our vision to be Queensland’s best regional bank. A key part of the service proposition we offer to Members and Queensland’s communities, is providing loans to help people purchase houses, cars and invest in their businesses. The last 12 months has seen Queensland Country Bank achieve record lending with loans funded approaching $1 billion. This means we have been able to help more Queenslanders in the past year to pursue their financial goals.

The bank has been able to achieve a sound financial performance that has seen an increase in profit and strong growth in the balance sheet as we balance the importance of providing Members with very competitive products and services while maintaining a sound financial performance to meet our prudential requirements of capital and liquidity.

Read more from our CEO, Aaron Newman

During the year we have also progressed some important initiatives to expand access to services and the range of services we offer. I have reported in a previous newsletter that we were progressing with the introduction of a new branch and I am now pleased to advise our new branch is now open in Maroochydore on the Sunshine Coast. The new branch provides our Members on the Sunshine Coast with access to a modern face to face environment with technology included that enables video access to banking advice.

We have also been making other investments in our branch network with works progressing to move our Townsville City branch to a new location to provide a larger and more modern environment for Members and staff in a more accessible location in the city. Further information will be shared with Members as the works progress.

We are passionate about providing face to face service to Members, particularly in regional areas and have been advocating positively for the Federal Government to progress with a regional bank branch levy that supports the continuation of banking in regional and rural Australia. The Federal Government introduced the concept during the Federal election campaign which would levy a fee on banks that withdraw branch services from regional Australia. The funds raised would then support those banks that continued to offer branches in regional Australia. This would enable the services to continue and could lead to an expansion of branches. We will continue to follow this government initiative and add support where appropriate.

In relation to accessing a wider range of banking services, Queensland Country Bank has made the decision to expand our services to better meet the needs of rural Queensland. Our products and services are currently expanding to meet the needs of the agricultural sector. We now offer banking services for farmers and graziers with dedicated staff who are experts in delivering agribusiness products for lending and investing including our newly introduced Farm Management Deposit Account. For more information, speak with your local branch or visit our website.

One way that we measure the value we are delivering for Members, relative to competitors is engaging with Canstar and other consumer rating companies to assess our products. Through the past year, we have seen Queensland Country Bank recongised as providing some of the best value loans and deposit products in Queensland and Australia. We received Outstanding Value awards from Canstar for our home and investment loans along with Experts Choice awards from Mozo for investment loans and our Pensioner account. We also received WeMoney best product awards for our rewards credit card and car loans, along with Customer Owned Bank of the year.

Members also often provide feedback on the products and services we offer which is considered as we make changes to the way we provide banking. Thank you for your continued feedback and support and I look forward to announcing more great new initiatives that we have planned for the balance of this year.

Aaron Newman

Chief Executive Officer

Making a Difference across Queensland with Community Grants

Over the years, we’ve had the privilege of supporting the people and projects that help Queensland communities flourish. Through our Good for Good Community Grants program, we’ve seen local initiatives bring real, lasting change to countless lives — often in quiet but powerful ways.

Applications are now open for the next round of funding, with grants between $5,000 and $30,000 available to eligible community groups and not-for-profit organisations working to make a practical difference where it’s needed most.

Last year we provided a total of almost $150,000 in funding to 15 organisations, each with a unique project aimed at making a positive impact in our communities. Here's a snapshot of what we accomplished:

North Queensland

- COUCH Wellness Centre (Cairns): Funded a series of workshops in nutrition, art, and music therapy for individuals impacted by cancer.

- Far North Queensland Wildlife Rescue (Cairns): Essential resources for carers to aid local wildlife.

- Mulgrave Combined Cricket Association (Yarrabah): Empowering female Indigenous and Indian communities with cricket equipment and transport.

- Outback at Isa (Mt Isa): Artistic skill-building for at-risk young people through an Indigenous-led mural project.

- Mount Isa and District Athletics Club (Mt Isa): Shade tents ensuring comfort and protection during athletic events.

- Fuel For Schools (Townsville): A new delivery vehicle to support breakfast programs in schools.

Central Queensland

- Charters Towers Civic Club (Charters Towers): Solar power installation to enhance sustainability and reduce costs.

- Mackay Surf Life Saving Club (Mackay): Beach matting to promote inclusivity for all community beachgoers.

- Big Birds Nest Childcare Center (Ayr): New cots to improve safe sleep practices and attract new families.

- Collinsville Community Association (Collinsville): Painted recreation areas to engage local youth in active play.

South East Queensland

- Stanthorpe & District Cricket Association (Stanthorpe): Upgraded pitch covers and equipment to support players and curators.

- Bramble Bay Women’s Shed (North Lakes, Brisbane): New machinery and equipment, making the shed space safer and more functional.

- Cystic Fibrosis Queensland: Providing spirometers for children in regional and rural areas across Queensland.

- Western Districts Netball Association (Brisbane): Enabling participation amongst girls in the community through equipment and registration support.

The program will remain open to receive entries until 31 August, 2025. Learn more on our community grants page.

Member Survey - What Matters Most?

What matters most to YOUR community?

Queensland Country Bank has proudly supported our communities for over 50 years. From local education initiatives to health projects and sports programs, we’ve been there, investing in what matters. Now, we’re turning to you to guide us forward.

What issues, projects, or causes do you care about the most?

There are some fantastic rewards up for grabs for those who participate in our 'what matters most?' survey! 🎉

Here’s what you could win*:

✅ Win 1 of 20 $100 cash prizes just for completing the survey. Transferred directly to your nominated Queensland Country Bank account if you're drawn as a winner.

✅ Nominate a community group or charity for their chance to receive a $2,500 donation to support the work they do.

How to Participate:

👉 Visit queenslandcountry.bank/whatmattersmost to complete the survey online.

👉 Share your feedback about what matters most to you.

👉 Nominate a local charity or group that’s close to your heart in 25 words or less (optional).

*Terms and conditions apply and can be found at queenslandcountry.bank/whatmattersmost

Money Mentors Success Story

How Queensland Country Bank Money Mentor Dee Helped This Couple Make Their Dream a Reality

When the dream of owning a home feels out of reach, it can be easy to lose hope. But what if you could have someone in your corner, cheering you on and guiding you every step of the way? That's exactly what our complimentary Money Mentor service can help with. This is the story of Michelle and her partner, who overcame financial struggles with the support of one of our Money Mentors, Dee, and made their dream of owning a home a reality.

From Regret to Real Estate – Michelle’s Story:

“For years, we carried the weight of financial regret — poor decisions in our younger years made the dream of owning a family home feel more like a fantasy than a future plan. We had no idea how to break free from the cycle of debt and credit cards, and we couldn’t see a clear path forward.

That all changed when we met Dee from the Townsville Money Mentors team. With warmth, wisdom, and a serious talent for turning chaos into calm, Dee helped us shift from a ‘spend now, panic later’ mindset to one grounded in saving, planning, and confidence.

Our goal? Become debt free and buy our first home within 12 months. Spoiler alert: We did it! 🎉

Thanks to Dee’s ongoing support, smart strategies, and genuine encouragement, we not only hit our goal but gained something even more valuable — financial freedom. We no longer lie awake wondering how we’ll pay the next bill or if we can afford a little getaway. The money is there, the plan is working, and the stress is gone.

Dee didn’t just cheer us on; she celebrated every win, big and small, like it was her own. If you're thinking about working with a Money Mentor, for us, it’s been life-changing.”

How Dee Helped Turn the Dream Into Reality

Dee’s approach with Michelle and her partner was rooted in breaking their financial goal into manageable, practical steps.

Dee highlights how accessible credit and Buy Now Pay Later options can sometimes create unforeseen costs. "Why wait when you can have it today and pay off in instalments? Many people are drawn to these arrangements without fully understanding the fees and costs involved," Dee explains.

Some interest-free arrangements may seem appealing at first but could come with hidden charges such as management fees, missed payment penalties, or massive interest hikes for overdue payments. "If these costs compound," Dee notes, "they can significantly increase the amount you owe and create a snowball of stress."

A Simple but Effective Debt Reduction Strategy

To help Michelle and her partner, Dee employed a clear and proven debt reduction strategy.

1. List Debts from Smallest to Largest

List out their debts, starting with the smallest ones and working their way to the largest.

2. Focus on One Debt at a Time

By concentrating all their extra payments on their smallest debt first, they could pay it off quickly while maintaining only the minimum payments on the rest.

3. Celebrate Every Win

Once a debt was cleared, Dee emphasised celebrating the achievement. This mindset shift helped Michelle and her partner stay motivated to tackle the next debt.

4. Snowball the Payments

The money they had been using for the first debt was then applied to the second debt, increasing the repayment amount. Over time, this snowball effect helped them pay off their debts faster.

Our Money Mentors help guide Members towards understanding the impact of their financial decisions. "Debt can sometimes keep people trapped, living week to week, because their money could be tied up in repayments. Breaking free means gaining the freedom to save and plan for the future," Dee explains.

Dee acknowledges that changing financial habits can take time and that bumps in the road are to be expected. "It’s a marathon, not a sprint," she says. "Having someone in your corner to guide you along the way can make all the difference."

Take the First Step

Michelle and her partner’s story shows that with guidance, determination, and the right strategies, achieving your financial dreams is possible. Whether you’re dealing with debt or saving for your first home, Queensland Country Bank’s Money Mentors are here to support you every step of the way.

Connect with a Money Mentor today.

* This service and guidance provided by Money Mentors is for educational and informational purposes only and is general in nature and does not constitute to personal advice. Before acting on the above you should seek your own advice.

Three Years Strong: Queensland Country Bank Recognised as Great Place To Work Again

We’re proud to share that Queensland Country Bank has officially been recognised as a Great Place to Work® for the third year in a row!

This prestigious certification, awarded through the 2025 Great Place to Work Trust Index® Survey, celebrates organisations across Australia that foster exceptional workplace culture and deliver outstanding employee experiences. For us, it’s a powerful reflection of the values we live every day.

To earn this recognition our team participated in a comprehensive survey covering everything from connection to the community, innovation and inclusiveness, to team camaraderie. Of the 279 employees who completed the survey, an impressive 89% said they consider Queensland Country Bank a great place to work—a testament to the strong sense of community and purpose we’ve built together.

We believe that when our people feel heard, supported, and empowered, they’re able to do their best work—not just for each other, but for our Members too. Creating a culture where everyone has a voice and a chance to contribute meaningfully remains one of our highest priorities.

Tristan Scott, Business Development Manager in Maroochydore reflected on the achievement.

“Being recognised as a “Great Place to Work” for the 3rd year in a row means a lot. I see the key components of what we do as listening to our Members so that we can help them achieve their financial goals. This can only work if we are engaged and tuned in. Choosing the right staff and supporting them to perform in their roles, is critical to executing outcomes for our Members. Our Members can see the evidence of that via the focus and engagement of Queensland Country Bank Staff when they visit us.”

Ronald McDonald House Charities North Australia – Charity Partner

From Teething to a Life-or-Death Fight: Tobias’s Story

At just four months old, Tobias’s parents thought he was teething. But within hours, he was fighting for his life.

Rushed from Cairns to Townsville, Tobias’s mum Katie flew beside him, while dad Stephen and the kids drove—unsure if they’d arrive in time. What began as an ordinary day became every parent’s worst nightmare. Tobias had meningococcal disease and was critically unwell.

“We had to let him decide whether to stay or go,” said Katie. “There was never a choice for us. We weren’t going anywhere.”

To survive, Tobias needed all four limbs amputated. Every moment was touch and go.

“At first it was minute by minute… then hour by hour. Then back to minute by minute.”

Through the most traumatic time of their lives, Ronald McDonald House was their lifeline. Katie and Stephen stayed 169 nights — supported with meals, a warm bed, and space for their other children to stay close.

“Without Ronald McDonald House, we wouldn’t have made it. It kept our family together and gave us one less thing to worry about.”

Today, Tobias is thriving — still facing challenges, still returning for care, and still supported by RMHC North Australia.

In 2025, Together We Can Do More

At Queensland Country Bank, we believe that real impact happens when communities come together. That’s why in 2025, we're proud to deepen our support for Ronald McDonald House Charities North Australia - because together, we can do more for families in need.

From emergency accommodation near hospitals to warm meals and respite spaces, RMHC North Australia is supporting families across more than 1.3 million square kilometres, keeping them close to their child’s hospital bed when it matters most.

We invite you to be part of this collective impact. Your tax-deductible donation* today helps families like Tobias’s stay together through medical crisis.

Make a donation

*Donations made before 1 July 2025 may be eligible for a tax deduction in the 2025 financial year. Visit the relevant ATO website for official guidance.

Member Benefits

As part of our commitment to our communities, we sponsor a number of major events, which also unlocks benefits for our Members through discounted tickets to events and games.

Take a look at some of the upcoming and existing offers available from our partners.

Get to know your mobile app

Take some time to login and explore your mobile banking app. Once you start tapping around, there could be features to discover that make your banking experience even better.

Travel notifications:

Register your travel plans with us to let us know it’s really you making those

overseas purchases.

Menu > Overseas travel > Register your travel plans

Personalise your shortcuts:

Manage your bottom menu shortcuts on your dashboard to select the items you use most. Drag and drop the icon into your bottom menu from Dashboard Shortcuts for quick access to things like Card Management, Pay, Accounts and more.

Menu > Settings > Dashboard shortcuts

Set up a quick transfer

Pay between two of your accounts regularly? You can setup a quick transfer for set amounts between $50 and $200, to transfer money without even logging into your app.

Menu > Pay > Quick Transfer Management

Identify your linked accounts

We’re excited to share that Members can now quickly check which account your Visa Debit or Credit Card is linked to.

1. With your app open, tap the menu in the top-left corner.

2. Select ‘Card Management’.

3. Tap the image of your card.

4. Choose ‘Linked Account’.

Here, the account associated with the selected card will be displayed.

If you have any suggestions for how we can continue to make our app even better,

your feedback is welcome – email us your ideas to info@queenslandcountry.bank.